Do you want to be a digital nomad in Spain and you are looking for a new and exciting destination to live and work remotely?

Look no further! the culture, stunning landscapes, and its excellent internet infrastructure makes Spain the perfect place for digital nomads to thrive.

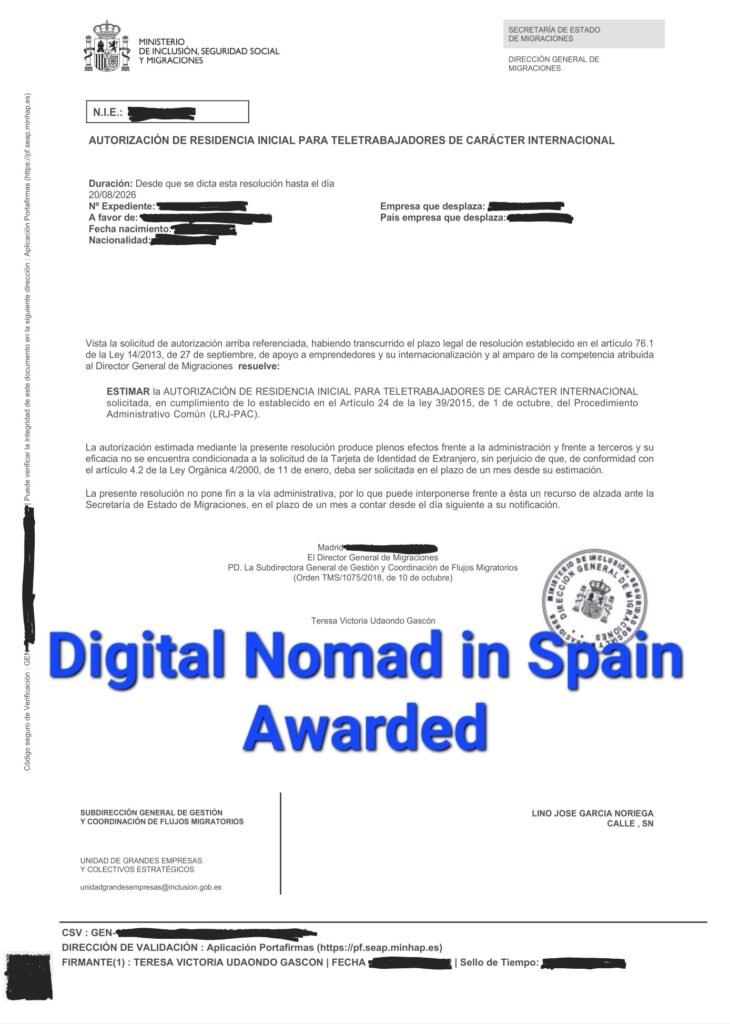

In June 2023, Spain launched its digital nomad visa program.

This program makes it even easier for foreign citizens to live and work in the country

In this comprehensive guide, we’ll walk you through the requirements and application process for the digital nomad visa, as well as provide insights into the best digital nomad destinations in Spain.

Want to start the process?

SCHEDULE YOUR VIDEO CONSULTATION NOW

1. Introduction to the Digital Nomad Visa in Spain

In January 2023, Spain introduced its digital nomad visa as part of the new Startup Act, aimed at encouraging entrepreneurship and foreign investment.

The digital nomad visa allows non-EU/EEA remote workers and freelancers to live and work in Spain for up to 12 months initially, with the option to extend for up to five years.

This visa is a game-changer for those who want to experience the beauty and culture of Spain without committing to long-term residency.

2. Benefits of Living and Working Remotely in Spain

Spain offers a multitude of benefits for digital nomads. From its rich history and vibrant culture to its stunning landscapes and world-renowned cuisine, Spain has something to offer everyone.

As a digital nomad, you’ll have the opportunity to explore historic cities, relax on beautiful beaches, and immerse yourself in the local culture.

Spain also boasts excellent internet infrastructure, making it easy to stay connected and productive while working remotely.

Additionally, the cost of living in Spain is relatively affordable compared to other European countries, allowing digital nomads to enjoy a high quality of life without breaking the bank.

3. Taxes and Social Security Contributions in Spain for the Digital Nomad

As a digital nomad, you must comply with tax obligations.

If you spend more than 183 days in Spain during a calendar year, you are considered a tax resident.

So you must comply with Spanish tax laws, including social security

4. Requirements for the Spain Digital Nomad Visa

To be eligible for the digital nomad visa in Spain, non-EU/EEA citizens must meet certain requirements.

These requirements include proof of remote worker status, financial self-sufficiency, full health insurance coverage, a clean criminal record, and a minimum stay requirement.

Let’s take a closer look at each of these requirements:

Proof of Remote Worker Status

As a digital nomad, you must be able to demonstrate that your work can be performed remotely.

This can be demonstrated by current and previous work contracts, a professional certificate or at least three years of relevant work experience in your current field.

Also, with a certificate of professional experience and accredited experience.

If you are self-employed, you can work with Spanish clients as long as it does not exceed 20% of your total income.

Attention: if your country does not have a social security agreement with Spain, a new company must be incorporated in Spain before you can be registered with the social security.

Proof of Financial Self-Sufficiency

To qualify for the digital nomad visa, you must demonstrate financial stability.

Your income must be higher than 200% of the SMI, for example approximately 2,268 euros per month or 27,216 euros per year.

If you are accompanied by a partner or dependents, higher income brackets apply.

You’ll need to provide bank statements, payslips, and employment contracts as proof of your income.

Full Health Insurance Coverage

It is essential to have full health insurance coverage for yourself and any accompanying family members for the entire duration of your stay in Spain.

While there are discussions about allowing digital nomads to pay into the Spanish public health insurance system.

For now, you must obtain private health insurance authorized to operate in Spain.

No Criminal Record

Applicants must not have a criminal record.

A certificate from the country of origin and other countries in which they have resided for the last five years must be provided.

Criminal record certificates must be apostilled and with official translation.

Legal status in Spain

If you are currently in Spain without the proper legal authorization, you will not be able to apply for the digital nomad visa.

But if you are within 90 days from entry into Spain you can apply for the residency application.

5. Step-by-Step Application Process for the Spain Digital Nomad Visa

Applying for the digital nomad visa in Spain involves several steps.

Let’s walk through the process:

Collecting Necessary Documents

The first step is to gather all the necessary documents for your visa application.

These documents include:

- Completed national visa application form.

- Valid passport with at least one year of validity

- Employment contract

- Proof of income

- Qualifications and experience

- Medical insurance or agreement

- Criminal record clearance certificates

- Family ties

Booking an Appointment and Paying the Visa Fee

Once you have collected all the necessary documents, you’ll need to book an appointment at your local Spanish embassy or consulate.

The appointment scheduling procedure varies depending on the embassy, so visit the official website for precise guidelines.

You will also need to pay the non-refundable visa fee, which is usually around €80.

Attending the Appointment

At your appointment, you will need to provide all the required documentation.

Your passport will be temporarily held by the embassy or consulate while they assess your application.

They may also make copies or verify your documents during the appointment.

Waiting and Collecting Your Visa

After your appointment, it can take between 15 and 45 days for your visa application to be processed.

You may be asked to submit additional documentation or attend an interview if necessary.

Once your application is approved, you have one month to collect your visa from the embassy or consulate.

If your application is declined, you will be notified in writing with the reasons for rejection.

You have one month to submit extra documentation and appeal the decision if desired.

Applying for NIE and NIF

Once in Spain, you will need to apply for a NIE (foreigner identification number) and a NIF (tax identification number).

These are necessary for various purposes, such as opening a bank account.

You can apply for them at the Oficina de Extranjeros (Foreigners’ Office) or at a police station in Spain.

6. Taxes for Digital Nomads in Spain

As a digital nomad in Spain, it’s important to understand your tax obligations.

If you spend more than 183 days in Spain during a calendar year, you are considered a tax resident and must comply with Spanish tax laws.

The tax rate for non-residents on a digital nomad visa is 24% for income up to €600,000 per year, with any earnings above this amount taxed at 48%.

Spain has double taxation agreements with many countries, which means you may not have to pay tax on the same income twice if you’re already taxed in your home country.

7. Digital Nomad Destinations in Spain

Spain offers a diverse range of destinations for digital nomads. Here are five of the best digital nomad destinations in Spain:

Barcelona

Barcelona, the capital of Catalonia, is a bustling city with a rich history and vibrant culture.

It offers a unique blend of work and leisure, with co-working spaces offering beachfront views and iconic attractions like the Sagrada Familia and Park Güell.

The city is known for its fusion of Catalan and Spanish cuisines, making it a food lover’s paradise.

Valencia

Situated on the Mediterranean coast, Valencia is a city with a relaxed yet innovative vibe.

It is more affordable than other Spanish cities and has a growing tech and startup ecosystem.

The City of Arts and Sciences is a must-visit attraction, showcasing futuristic architecture.

With comfortable weather year-round, Valencia is perfect for digital nomads who enjoy outdoor activities.

Madrid

As the bustling capital of Spain, Madrid offers a wide range of opportunities for digital nomads.

It is a business, cultural, and creativity hub, with abundant co-working spaces, networking events, and workshops.

Madrid strikes a balance between productivity and entertainment, with historic landmarks, dynamic nightlife, and a thriving arts scene.

Malaga

Located on the Costa del Sol, Malaga is a popular destination for digital nomads.

It has a Mediterranean charm, beautiful beaches, and a growing expat community.

The city offers various co-working spaces and meetups, making it easy to connect with like-minded professionals.

With its sunny climate and relaxed lifestyle, Malaga is an ideal place to live and work remotely.

Palma de Mallorca

Palma de Mallorca, the capital of the Balearic Islands, is known for its picturesque landscapes and vibrant cultural scene.

The city offers cozy co-working spaces and regular networking events, providing the structure needed for digital nomads.

The island lifestyle, combined with the stunning natural beauty of Mallorca, creates a unique and inspiring environment.

8. Internet Infrastructure and Co-Working Spaces in Spain

Spain has excellent internet infrastructure, making it a top destination for digital nomads.

The country boasts high-speed internet connections and widespread coverage, ensuring a reliable and efficient work environment.

There are also numerous co-working spaces available throughout Spain, catering specifically to digital nomads.

These spaces provide a productive and collaborative atmosphere, with amenities like high-speed internet, meeting rooms, and networking events.

9. Cost of Living for Digital Nomads in Spain

One of the advantages of living in Spain as a digital nomad is the relatively affordable cost of living compared to other European countries.

The cost of accommodation, food, transportation, and entertainment is generally lower in Spain, allowing digital nomads to enjoy a high quality of life on a reasonable budget.

However, it’s important to note that the cost of living can vary depending on the city and region you choose to live in.

10. Healthcare and Insurance for Digital Nomads in Spain

While Spain has a high-quality public healthcare system, digital nomads are currently required to have private health insurance that covers the full duration of their stay.

It is important to ensure that your health insurance policy is authorized to operate in Spain and provides comprehensive coverage for medical emergencies and other healthcare needs.

Additionally, it’s advisable to have travel insurance that covers trip cancellation, lost luggage, and other unforeseen circumstances.

11. Cultural Highlights and Activities for Digital Nomads in Spain

Spain is a country rich in cultural heritage and offers a wide range of activities and attractions for digital nomads to explore.

From visiting historic landmarks like the Alhambra in Granada and the Alcazar in Seville to experiencing vibrant festivals like La Tomatina in Buñol and Las Fallas in Valencia, there is always something exciting happening in Spain.

The country is also known for its delicious cuisine, with each region offering its own unique dishes and specialties.

12. Conclusion and Final Tips for Digital Nomads in Spain

Living and working remotely in Spain as a digital nomad is an exciting and rewarding experience.

With its stunning landscapes, vibrant culture, and excellent infrastructure, Spain is an ideal destination for those seeking a balanced lifestyle.

By following the application process for the digital nomad visa, understanding your tax obligations, and exploring the best digital nomad destinations in Spain, you’ll be well-equipped to embark on your Spanish adventure.

Remember to embrace the local culture, connect with other digital nomads, and make the most of everything Spain has to offer. ¡Bienvenidos a España!

Frequently asked questions

There are differences between the visa option and the direct residence permit option.

If you belong to a visa-exempt country you can apply directly when you are in Spain but within the first 90 days.

If you belong to a country where you need a visa, you must submit your application to the Spanish Consulate.

Do not confuse non-profit residency with the digital nomad permit.

Non-profit residency does not allow you to work, only reside and live off savings or recurring income.

There are countless rulings from the Superior Court of Madrid that deny non-lucrative residency to applicants who say they telework.

24% Fixed rate on your work income up to €600,000.

48% on any amount that exceeds that threshold.

This special tax regime offers advantages compared to the general progressive tax rate.

Regarding global income, you must always be aware of double taxation agreements.

If there is an agreement, you may not have to pay taxes twice.

However, individual circumstances may vary.

Therefore, it is recommended to consult with a tax lawyer.

In Spain there is no officially recognized city as a digital nomad territory.

Any place in Spain can be used for the teleworker to carry out their activities from Spain.

The digital nomad authorization is in third position within the types of authorizations of the UGE.

5,140 Requests

3,293 Concessions

75% effective

We think that by 2024 these figures can increase.

It is always advisable to have health insurance.

Although there is an agreement on social security with Spain.

The requirements are common but vary depending on the professional or corporate nature of the work.

I am traveling to Spain on April 1st and I want to apply for a digital tomato visa, how much time in advance should I gather the documents and how long does the process take?

To apply for a residence permit as a digital nomad there are 2 options

One option with a visa at the Spanish Consulate in your country of origin or current residence.

Another option is to enter as a tourist and apply within 90 days of your entry into Spain. For this option take into account that certain documents are usually valid for 3 months from their issuance and not from their apostille or legalization. In conclusion, if you come as a tourist to apply for the residence permit as a digital nomad in Spain, you must have the documents in force and issued within 3 months.

I remain at your service to advise you on an ongoing basis.